Seems like all the interesting news is coming out of Southern California these days.

Seems like all the interesting news is coming out of Southern California these days.

This time, it’s about our old friend, the interest only mortgage.

Never mind the fact that this was one of the chief contributing factors in the housing crash just a few short years ago.

Times are good and money is cheap, so hey! Lets get the party started.

The article is from the Dr Housing Bubble Blog. A link to the original article is below.

The interest only loan is back but in a very specific way. There are a few people with relatively high incomes that are using these to their advantage.

I decided to run a quick test trial on this to see what it would cost to go with an interest only loan on a $1,000,000 home purchase. The answer might surprise many but it highlights the incredible leverage that low rates are providing to buyers. It also highlights how low rates favor large financial firms (i.e., hedge funds, etc) and those with high incomes. While the regular family might save a few hundred dollars a month they are still paying tens of thousands more on the sticker price. Combine that with the flood of big money into the market and you get the current housing market. What if I told you that you can get a $1,000,000 home for a $1,900 monthly payment? Not possible? Then we have the loan product for you.

The interest only loan

Interest only loans are pretty much what they say they are. You essentially pay interest for a set amount of time (no principal). The balance doesn’t change and you simply pay the interest of the money borrowed. While the NINJA products are gone, these are open to those with large down payments (take a look at the all-cash crowd).

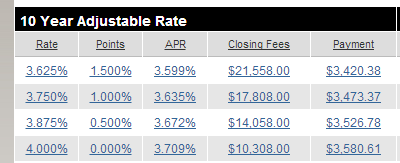

Let us say we are in the market to buy a $1,000,000 home and have a 25 percent down payment ($250,000). This means we will be opting for a $750,000 mortgage. What products are available to us? You can go with a 10-year ARM:

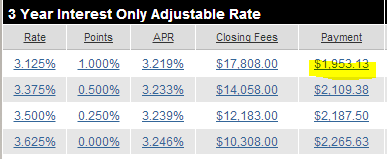

The benefit here is that you are paying down principal during this timeframe but the monthly payment will work out to be $3,420 (only for P + I). I thought you said you could get this down to the $1,900 range? Well take a look at a more aggressive option (a 3-year interest only product):

This is incredible if you think about it. You can get your hands on a $750,000 loan and simply pay $1,953 per month for 3-years. Keep in mind for higher income households the mortgage interest deduction is a major method of minimizing a tax burden. This is really a subsidy to wealthier households given that married couples already get an $11,900 standard deduction. According to an IRS study 63.3 percent of taxpayers claim the standard deduction.

For most families, the math on the mortgage interest deduction is non-consequential and less than they think they are getting (unless you live in inflated states where this simply becomes a subsidy for higher income households). And this example of the interest only loan gives you a perfect glimpse as to why.

For the household going with the 3-year interest only loan, they are going to take the MID of $23,436 a year plus, they are likely paying much lower monthly payments versus renting a similar home (a double-subsidy). Depending on what neighborhood, we are probably looking at $4,000 or $5,000 in rent. Also, you can write-off other items like taxes (around $12,000 per year).

Why use hypotheticals. Let us go shopping and see what we can find:

694 S Oak Knoll Ave, Pasadena, CA 91106 (Pictured above)

Bedrooms:Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â 3.5

Square feet:Â 2,200

This place just sold for $1,000,000 on 7/12/2013. Someone wanted to get more here:

Not a bad gain even though they wanted $1,399,000 back in March. How you drop $400,000 (40 percent) in four months just demonstrates the manic pricing we are currently seeing. Yet someone bought this for $1,000,000 just a few days ago. So our above numbers will pan out on this place.

It actually makes total sense to pay $1,953 and leverage the heck out of the low interest environment we are in especially for high income households. Yet you can see how this becomes a maximum subsidy for those that least need it (instead of the arguments you hear about helping working families purchase a modest home). The shell game is to inflate prices and provide massive subsidies in the form of mortgage interest to large income households. As previously mentioned, over 63 percent of households in the US go with the standard deduction (while many others get a tiny benefit when itemizing). This is the tiny sliver of how you can use taxpayer incentives to leverage out easy access to debt. Member banks can borrow at virtually zero. Banks then make massive margin on credit cards, loans, and other items. If it all goes bad, they will get bailed out. Wealthier households can use this interest only loans to maximize their after-tax savings.

Welcome back interest only loans!

You can find the article here:Â http://www.doctorhousingbubble.com/interest-only-loan-million-dollar-home-purchase-tax-deduction-interest-mortgages/

1 thought on “How to buy a $1 million home for $1,900 a month!”