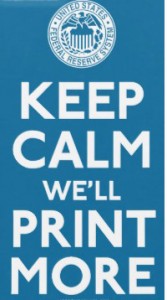

Shocking I know. That hasn’t happened since Paul Volcker.

Shocking I know. That hasn’t happened since Paul Volcker.

But it’s about time.

I just saw a piece in the New York Times titled “Fed Dissenters Increasingly Vocal About Inflation Fears”.

I was both happy and frightened to see that headline. Happy because the Fed needs to face up to the fact that interest rates can’t stay at zero forever, and frightened by what’s going to happen to the economy when (if) interest rates ever get back to anything resembling a market rate.

And then there’s inflation.

I’m an econ major. I’ve been following this stuff since 2006 and 2007. I’m confounded but the fact that we haven’t seen any inflation yet. It’s out there. But if or when it will ever hit is anyone’s guess.

The first paragraph of the piece is what gives me a glimmer of hope:

“An increasingly vocal minority of Federal Reserve officials want the central bank to retreat more quickly from its stimulus campaign, arguing that the bank has largely exhausted its ability to improve economic conditions.”

I’ve included the piece below without further comment. Let me know what you think.

Fed Dissenters Increasingly Vocal About Inflation Fears

By BINYAMIN APPELBAUMAUG. 20, 2014

WASHINGTON — An increasingly vocal minority of Federal Reserve officials want the central bank to retreat more quickly from its stimulus campaign, arguing that the bank has largely exhausted its ability to improve economic conditions.

The debate, reflected in an account of the Fed’s most recent policy-making meeting published on Wednesday, is likely to dominate the gathering of central bankers and economists at Jackson Hole, Wyo., Thursday through Saturday.

Fed officials are convinced that the economy is gaining strength after the years of false starts, but a majority of policy makers, led by the chairwoman, Janet L. Yellen, favors a slow retreat from the Fed’s efforts to encourage job creation. They note that millions of people still cannot find jobs, while inflation remains relatively weak.

At the July meeting, however, a number of officials described a growing risk that the Fed’s control of inflation is being loosened by its focus on job creation. They note that the economy has improved more quickly than expected in recent months. The remaining damage caused by the Great Recession, in this view, can no longer be repaired by keeping interest rates low through the Fed’s primary policy tool.

Officials, in other words, disagree about the proximity of the finish line.

“Participants generally agreed that both the recent improvement in labor market conditions and the cumulative progress over the past year had been greater than anticipated and that labor market conditions had moved noticeably closer to those viewed as normal in the longer run,†according to the account, released after a standard three-week delay. “Participants differed, however, in their assessments of the remaining degree of labor market slack and how to measure it.â€

Some analysts saw evidence that the Fed’s internal critics were exerting growing influence over the course of policy, suggesting that the Fed was becoming a little more likely to raise interest rates before the middle of 2015, now considered the most likely time for the Fed to begin raising rates from the near-zero level it has maintained since late 2008. “Some of the centrists appear to be acknowledging the rapid improvement in labor market conditions,†wrote Paul Dales, senior United States economist at Capital Economics.

Others said the debate was merely becoming more polarized, with the majority remaining firm in its views. “We continue to believe that the Fed will not move until at least mid-2015 despite some of the hawkish rhetoric which has recently grown louder,†wrote Michael Dolega, senior economist at the TD Bank Group.

Investors, too, appeared to share the uncertainty about the meaning of the minutes. The yield on the benchmark 10-year Treasury note rose after the Fed released the minutes at 2 p.m., then disgorged some of those gains, but still closed up for the day at 2.43 percent. Stocks first fell, then rebounded to pass the earlier high. The Standard & Poor’s 500-stock index ended at 1,986.51, up 0.25 percent on the day.

Ms. Yellen is scheduled to speak Friday morning at Jackson Hole, and she is expected to discuss the state of labor markets. The annual conference, hosted by the Federal Reserve Bank of Kansas City, has sometimes served as a platform for Fed leaders to signal policy changes, but more often as a highly publicized chance to explain their views.

The conference, this year on the theme of “Re-evaluating Labor Market Dynamics,†also is expected to offer an opening to Ms. Yellen’s critics, both internal and external, to press their side of the case. The president of the Kansas City Fed, Esther George, is among the strongest advocates of a faster retreat by the Fed.

One potential motivation for an earlier retreat has lost some of its urgency. The account said officials did not see much evidence that markets were overheating.

“Participants noted evidence of valuation pressures in some particular asset markets, but those pressures did not appear to be widespread and other measures of vulnerability in the financial system were at low to moderate levels,†it said.

But the unemployment rate has fallen more quickly than the Fed predicted at the beginning of the year. It stood at 6.2 percent in July. Price inflation has lately shown some signs of reviving, although it remains below the 2 percent annual pace the Fed regards as healthy.

Most officials, according to the minutes, take the view that the unemployment rate overstates progress in the labor markets, because an unusually large number of Americans have stopped looking for work but are likely to resume their

searches as the economy improves. Ms. Yellen has frequently espoused this view.

Wage growth also remains slow. The Fed for the first time described the slow pace of wage gains as a threat to growth.

But the question, increasingly, is whether these problems can be solved, or significantly improved, by easy monetary policy.

The Fed’s staff economists, who prepare a forecast for the policy makers, once again in July reduced their estimate of the maximum sustainable pace of growth and, in effect, their judgment of how many people were likely to return to work.

The account underscored that Ms. Yellen and her allies are not saying that the minority is wrong, but that the evidence is unclear. Policy, the Fed has said repeatedly, marches to the beat of the economic data. “Many participants noted that if convergence toward the committee’s objectives occurred more quickly than expected, it might become appropriate to begin removing monetary policy accommodation sooner than they currently anticipated,†the account said.

One committee member, Charles I. Plosser, president of the Federal Reserve Bank of Philadelphia, dissented at the July meeting, arguing that there was already reason enough for the Fed to change course. The minutes said officials also were “increasingly uncomfortable with the committee’s forward guidance†that the Fed expects to maintain its key short-term rate at its low level for some time.

1 thought on “Rational Thought from the Fed?”

Comments are closed.